Traders Manual

[ +

] Q. What is Account opening process at NYCE?

Ans.

Account opening is a manual process. Following is the flow followed by us for opening the trading account:

1. The client approaches and show interest in opening account with us.

2. We meet the client personally and if we are satisfied with his documents, nature of trading andexperience in trading we provide him hard copy of KYC form.

3. The client submits the hard copy either in person in our office or our executive visits at his place to collect the KYC form and supporting documents.

4. The supporting documents are physically verified with originals.

5. The client is informed about discrepancies, if any.

6. Upon verification of the KYC form and documents, the form is countersigned by company’s executives and then it is uploaded on KRA portal.

7. Upon successful uploading on KRA portal, the same is uploaded on Exchange’s portal.

8. The scanned copy of the KYC form is emailed/ handed over to the client

9. The client details are feed in the backoffice software and trading software

10. The client is ready to trade after depositing the margin money.

Following information / documents are required to open the account:

PAN details,

Aadhaar,

Bank Account details such as Bank Account number and IFSC,

Cancelled Cheque,

Bank account statement

[ +

] Q. How to file a complain?

Ans.

The complain can be filed in following ways:

1. Directly to the broker: In following ways complain can be filed with broker

i. Complain can be filed via writing in complain register available at reception at our office/s

ii. Complain can be mailed to Investor Grievances on investor.grievances@nyceindia.com

iii. Complain can be mailed to Compliance Officer on compliance@nyceindia.com

iv. Complain can be mailed to Directors or CEO on email id available on company’s website i.e.

www.nyceindia.com

v. Complain can mailed to the registered office of the company i.e.

NYCE Securities & Derivatives Ltd.

28, Ground Floor, JMD Megapolis, Sector-48

Gurgaon, Haryana-122018

2. Directly to Exchange:

For NSE: In absence of a response/complaint not addressed to your satisfaction, you may lodge

a complaint with:

URL investorhelpline.nseindia.com/NICEPLUS/

Email: ignse@nse.co.in

Contact Number: 1800 266 0058

For MCX: In absence of a response/complaint not addressed to your satisfaction, you may lodge

a complaint with:

URL: www.mcxindia.com/Investor-Services

Email: grievances@mcxindia.com

Contact Number: +91 22 66494070, 66494151

3. Directly to regulator (SEBI): Complain can be filed online on

URL: scores.gov.in/scores/Welcome.html

Upon filing of the complaint by the client or receiving the complaint, it is directly monitored by the

Compliance Officer and all efforts are taken to resolve it at the earliest. Upon resolution the client is

informed via email. The client can call or email directly to compliance officer to know the status of

his/her complain.

If the client is not satisfied with the resolution by the company, the client is free to file is before the

higher authorities as mentioned above.

[ +

] Q. What is Account closing process at NYCE?

Ans.

Account closing is a manual process. Following is the flow followed by us for closing the trading account:

1. The client can email / send physical copy stating he wants to close the trading account.

2. We meet the client personally and discuss the reason for his account closure.

3. We ensure he is not having any open positions in his account, if he has then we ask him to first close the open position.

4. The client is informed about discrepancies, if any.

5. His balance is then credited to his bank account.

6. Upon successful verification, the same is uploaded on Exchange’s portal (UCI/UCC in updated).

Following information are required to open the account:

UCI/UCC Id,

PAN details,

Aadhaar

[ +

] Q. What is saving?

Ans. In common usage, saving generally means putting money aside.

For example, by way of putting money in the bank or investing in some avenue. Thus

it is that part of the disposable income which is not spent on current consumption;

i.e disposable income less consumption.

[ + ]

Q. Why do I save at all?

Ans. You need to save because when you do so you are putting something

of yours into something else in order to achieve something greater. In simple words

you need to save because the money you save can be used for investment. When you

invest your savings in a stock, bond, mutual fund or real estate you do so because

you think its value will appreciate over time.

[

+ ] Q. What is an Investment?

Ans. Investing money is putting that money into some form of “security”

– an oft quoted word for anything that is “secured” by some assets. Stocks, bonds,

mutual funds, certificates of deposit – all of these are types of securities. As

with anything else, there are many different approaches to investing. For the purposes

of this explanation, there are three basic styles of investing: conservative, moderate,

and aggressive. In brief, a conservative investor wants to protect principal and

earn income; a moderate investor is willing to take a certain amount of risk to

achieve some stock price appreciation as well as current income; and an aggressive

investor is primarily concerned with high overall returns even though it means taking

risk.

[ + ] Q. What are the different modes of Investment?

Ans. There are three basic types of investments, also known as asset

classes, all of which we are going to discuss. These investments are stocks, bonds

and cash. You can buy stocks and bonds as individual investments, or you can invest

in them by buying mutual funds that own stocks, bonds or a combination of the two.

If you invest in cash, you can put money into bank accounts and money market mutual

funds or you can buy what are known as cash equivalents: Treasury bills, Certificates

of Deposit and similar investments.While you may not think of bank accounts as investments

because they currently pay an abysmally low rate of interest. On the other hand,

stocks and stock mutual funds have been the most profitable investments over time.

[ + ] Q. What are the basic investment objectives, which drive the investor?

Ans. The options for investing our savings are continually increasing,

yet every single investment vehicle can be easily categorized according to three

fundamental characteristics – safety, income and growth – which also correspond

to types of investor objectives. While it is possible for an investor to have more

than one of these objectives, the success of one must come at the expense of others.

Here we examine these three types of objectives, the investments that are used to

achieve them and the ways in which investors can incorporate them in devising a

strategy.

Safety

Probably there is truth in the fact that there is no such thing as a completely

safe and secure investment. Yet we can get close to ultimate safety for our investment

funds through the purchase of government-issued securities, or through the purchase

of the highest quality commercial papers. Such securities are arguably the best

means of preserving principal while receiving a specified rate of return.

Income

However, the safest investments are also the ones that are likely to have the lowest

rate of income return, or yield. Investors must inevitably sacrifice a degree of

safety if they want to increase their yields. This is the inverse relationship between

safety and yield: as yield increases, safety generally goes down, and vice versa.

In order to increase their rate of investment return and take on risk above that

of money market instruments or government bonds, investors may choose to purchase

corporate bonds or preferred shares with lower investment ratings. Most investors,

even the most conservative-minded ones, want some level of income generation in

their portfolios, even if it is just to keep up with the economy’s rate of inflation.

[ + ]

Q. What is Inflation?

Ans. A. Inflation is the rate at which the general level of prices

for goods and services is rising, and, subsequently, purchasing power of money is

falling. As inflation rises, every rupee will buy a smaller percentage of a good.

For example, if the inflation rate is 2%, then a Re.1 worth of a good will cost

Rs.1.02 in a year.

Growth of Capital

This discussion has thus far been concerned only with safety and yield as investing

objectives, and has not considered the potential of other assets to provide a rate

of return from an increase in value, often referred to as a capital

gain. Capital gains are entirely different from yield in that they are only

realized when the security is sold for a price that is higher than the price at

which it was originally purchased. (Selling at a lower price is referred to as a

capital loss.) Therefore, investors seeking capital gains are likely not those who

need a fixed, ongoing source of investment returns from their portfolio, but rather

those who seek the possibility of longer-term growth.

[

+ ] Q. What is a Capital Gain?

Ans.A. An increase in the value of a capital asset (investment or

real estate) that gives it a higher worth than the purchase price. The gain is not

realized until the asset is sold. A capital gain may be short term (one year or

less) or long term (more than one year) .It is to be noted that the money invested

grows with the passage of time. However the value of money received says n years

later may not be of same value as it is today. This concept is explained in Time

Value of Money.

Secondary Objectives

Tax Minimization

An investor may pursue certain investments in order to adopt tax minimization as

part of his or her investment strategy. A highly-paid executive, for example, may

want to seek investments with favourable tax treatment in order to lessen his or

her overall income tax burden.

Marketability / Liquidity

Many of the investments we have discussed are reasonably illiquid, which means they

cannot be immediately sold and easily converted into cash. Achieving a degree of

liquidity, however, requires the sacrifice of a certain level of income or potential

for capital gains.

[ + ] Q. Explain the Concept of Time Value of Money which you talked just a while

ago ?

Ans.

A. You have two payment options:

(A) Receive Rs.10, 000 now OR (B) Receive Rs.10, 000 in three years. Which one would

you choose? If you’re like most people, you would choose to receive Rs.10,000 now.

After all, three years is a long time to wait. Why would any prudent person defer

payment into the future when he or she could have the same amount of money now?

For most of us, taking the money in the present is just plain instinctive. So at

the most basic level, the time value of money demonstrates that, all things being

equal, it is better to have money now rather than later.

By receiving Rs.10,000 today, you can expect to increase the future value of your

money by investing and gaining interest over a period of time. For option B, you

don’t have time on your side, and the payment received in three years would be your

future value. To illustrate, we

.gif)

have provided the diagram of the timeline.

If you are choosing option A, your future value will be Rs.10, 000 plus any interest

acquired over the three years. The future value for option B, on the other hand,

would only be Rs.10, 000. But listen patiently to the subsequent part of Diksha

to find out how to calculate exactly how much more option A is worth, compared to

option B.

Future Value Basics

If you choose option A and invest the total amount at a simple annual rate of 4.5%,

the future value of your investment at the end of the first year is Rs.10,450, which

of course is calculated by multiplying the principal amount of Rs.10,000 by the

interest rate of 4.5% and then adding the interest gained to the principal amount:

Future value of investment at the end of first year:

= (Rs.10, 000 x 0.045) + Rs.10, 000

= Rs.10, 450

If the Rs.10, 450 left in your investment account at the end of the first year is

left untouched and you invested it at 4.5% for another year, how much would you

have? To calculate this, you would take the Rs.10, 450 and multiply it again by

1.045 (0.045 +1). At the end of two years, you would have Rs.10,920:

Future value of investment at end of second year:

= Rs.10, 450 x (1+0.045)

= Rs.10, 920.25

The above calculation is equivalent to the following equation:

Future Value = Rs10,000 x (1+0.045) x (1+0.045)

Think back to mathematics class in your high school, where you learned the rule

of exponents, which says that the multiplication of like terms is equivalent to

adding their exponents. In the above equation, the two like terms are (1+0.045),

and the exponent on each is equal to1. Therefore, the equation can be represented

as the following:

Future Value=Rs.10,000x (1+0.05)(1+1)

=Rs.10, 000x(1+0.045)2

=Rs.10,920.25

We can see that the exponent is equal to the number of years for which the money

is earning interest in an investment. So, the equation for calculating the three-year

future value of the investment would look like this:

Future Value=Rs.10,000x(1+0.05) (1+1+1)

=Rs.10,000x(1+0.045)3

=Rs.11,411.66

This calculation shows us that we don’t need to calculate the future value after

the first year, then the second year, then the third year, and so on. If you know

how many years you would like to hold a present amount of money in an investment,

the future value of that amount is calculated by the following equation:

Future Value=Original Amount x (1+Interest Rate per period) Number

of periods

or

P=1X(1+i)n

Present Value Basics

If you received Rs.10, 000 today, the present value would of course be Rs.10, 000

because present value is what your investment gives you now if you were to spend

it today. If Rs.10, 000 were to be received in a year, the present value of the

amount would not be Rs.10, 000 because you do not have it in your hand now, in the

present. To find the present value of the Rs.10,000 you will receive in the future,

you need to pretend that the Rs.10,000 is the total future value of an amount that

you invested today. In other words, to find the present value of the future Rs.10,000,

we need to find out how much we would have to invest today in order to receive that

Rs.10, 000 in the future. To calculate present value, or the amount that we would

have to invest today, you must subtract the (hypothetical) accumulated interest

from the Rs.10, 000. To achieve this, we can discount the future payment amount

(Rs.10, 000) by the interest rate for the period. In essence, all you are doing

is rearranging the future value equation above so that you may solve for P. The

above future value equation can be rewritten by replacing the P variable with present

value (PV) as follows:

Original Equation : FV=PV X (1+i)n

Final Equation: PV= FV/(1+i)n

Let’s walk backwards from the Rs.10,000 offered in option B. Remember; the Rs.10,000

to be received in three years is really the same as the future value of an investment.

If today we were at the two-year mark, we would discount the payment back one year.

At the two-year mark, the present value of the Rs.10,000 to be received in one year

is represented as the following:

Present value of future payment of Rs.10,000 at end of two year:

Rs.10,000 x (1+0.045) -1

=Rs.9569.38

Note that if today we were at the one-year mark, the above Rs.9, 569.38 would be

considered the future value of our investment one year from now.

Continuing on, at the end of the first year we would be expecting to receive the

payment of Rs.10,000 in two years. At an interest rate of 4.5%, the calculation

for the present value of Rs.10,000 payment expected in two years would be the following:

Present value of Rs.10,000 in one year:

Rs.10,000 x (1+0.045)-2

=Rs.9157.30

Of course, because of the rule of exponents, we don’t have to calculate the future

value of the investment every year counting back from the Rs.10,000 investment at

the third year. We could put the equation more concisely and use the Rs.10, 000

as FV. So, here is how you can calculate today’s present value of the Rs.10, 000

expected from a three-year investment earning 4.5%:

PV of three year investment=Rs.10,000x(1+0.05)-3

=Rs.8762.97

So the present value of a future payment of Rs.10,000 is worth Rs.8,762.97 today

if interest rates are 4.5% per year. In other words, choosing option B is

like taking Rs.8,762.97 now and then investing it for three years. The equations

above illustrate that option A is better not only because it offers you money right

now but because it offers you Rs.1,237.03 (Rs.10,000 – Rs.8,762.97) more in cash!

Furthermore, if you invest the $10,000 that you receive from option A, your choice

gives you a future value that is Rs.1, 411.66 (Rs.11, 411.66 – Rs.10,000) greater

than the future value of option

MORALE OF THE STORY: “A BIRD IN HAND IS WORTH TWO IN THE BUSH”. These

calculations demonstrate that time literally is money – the value of the money you

have now is not the same as it will be in the future and vice versa. So, it is important

to know how to calculate the time value of money so that you can distinguish between

the worth of investments that offer you returns at different times.

[ + ] Q. Would you please elaborate on the various Investment Options available

for me?

Ans.

A Yes, one can go for the following options:-

1) Investment in various instruments offered by Banks.

2) Stocks.

3) Derivatives.

4) Commodities.

5) IPO’s.

6) Mutual Funds. Any way do you think its necessary for me to tell you about the

investment options in banks?

NO THANKS SIR. O.K, then regarding other options I will be providing you with Deeksha

in the subsequent pages.

Q. Tell me more about Stocks.

A Lets define what a stock is. Simply speaking, stock is a share in the ownership

of a company. Stock represents a claim on the company’s assets and earnings. Holding

a company’s stock means that you are one of the many owners called shareholders

of a company. Generally, we are concerned with two types of stocks namely common

stock or equity shares and preferred stock or preference share. Stock prices are

determined by market forces of supply and demand. The system of trading stocks is

an anonymous screen based order driven trading system, which eliminates the need

for physical trading floors, i.e. open outcry systems. Brokers can trade from their

offices, using fully automated screen based processes. Their workstations are connected

to a Stock Exchange’s central computer system via satellite using Very Small Aperture

Terminus (VSATs) The orders placed by brokers reach the Exchange’s central computer

and are matched electronically. Such kind of trading system exists in two of the

national level stock exchanges i.e, Natonal Stock Exchange (NSE)&Bombay Stock

Exchange (BSE).

Q. It seems investing in stock is purely speculation as it’s quite uncertain

that I will have some return on my investment or I MAY EVEN LOOSE MY CAPITAL. Isn’t

it?

A. No, NOT AT ALL! Investing in stock is an art as well as science. Choosing a stock

requires lot of analysis and skills. Basically, share price movement is analysed

broadly by two approaches, namely fundamental Analysis & technical Analysis.

[ + ] Q. It seems investing in stock is purely speculation as it’s quite uncertain

that I will have some return on my investment or I MAY EVEN LOOSE MY CAPITAL. Isn’t

it?

Ans.

A. No, NOT AT ALL! Investing in stock is an art as well as science. Choosing a stock

requires lot of analysis and skills. Basically, share price movement is analysed

broadly by two approaches, namely fundamental Analysis & technical Analysis.

[ + ] Q. Explain me about the Fundamental and Technical Analysis.?

Ans.

A. Fundamental analysis is the examination of the underlying forces that affect

the well being of the economy, industry, and companies. As with most analysis, the

purpose is to derive a forecast and profit from future price movements. The fundamental

analysis is done on three levels namely economy, industry, and company. At the economy

level, fundamental analysis focuses on economic data to assess the present and future

growth of the economy. At the industry level, there is an examination of supply

and demand forces for the products offered entry or exit restrictions, etc. in that

particular industry. At the company level, fundamental analysis involves examination

of financial data, management, business concept and competition. Fundamental Analysis

includes financial statement analysis, shareholding pattern analysis, analysis of

Company business & Competitive environment, SWOT analysis & Risk associated.

[ + ] Q. It’s seems to be interesting. Explain me more?

Ans.

A. Well, Financial analysis includes analysis of Profit & loss statement &

Balance sheet. It includes analyzing historical performance of the company &

determining what the company is presently doing to predict about the future prospects

of the company. The profit & loss statement shows direct impact on the company’s

share value. If the company is performing well & generating good profit the

share value of the company will be respectively higher than the loss making companies.

General investors see net profit of the company but if we need to do in-depth analysis

of the company’s actual performance then one should track the net operating profit

of the company. It is because the net operating profit is the actual profit which

company generates from its actual business or operations. Net profit includes other

income, which is not generated from the actual operations of the business. Other

income includes interest earned from the investment etc. Balance sheet analysis

gives whole information about the companies assets & liabilities. Shareholding

pattern also state that what amount of total outstanding shares different groups

such as FII’s, Promoters, public etc are holding. Analysis of Company’s business

& the industry to which it belongs is yet another important issue in fundamental

analysis. With the help of the above analysis, an idea can be drawn on the health

of the company.

[ + ] Q. How can we proceed for such analysis ?

Ans.

A. The analysis is done with either of the two approaches: Top Down Approach &

Bottom UP Approach. In case of Top down approach, an investor looks at a country’s

economy before considering an industry to invest in. After choosing the industries

or sectors that will provide return well because of the economic conditions, then

the investor choose stocks from that particular industry or sector that are attractive

within that industry/sector and are likely to provide better returns. The approach

is quite useful in determining which sectors are attractive for particular period

of time. Bottom-up investing involves the investor’s attention on a specific company

rather than on the industry in which that company operates or on the economy as

a whole. The approach assumes that individual companies can do well irrespective

of the performance of the industry or economy even when the industry is not performing

very well.

In order to forecast future stock prices, fundamental analysis combines economic,

industry, and company analysis to derive a stock’s current fair value and forecast

future value. In technical terms, this fair value is known as the intrinsic value.

The purpose of analyzing a company’s fundamentals is to find a stock’s intrinsic

value, as opposed to the value at which it is being traded in the marketplace. If

the intrinsic value is more than the current share price, your analysis is showing

that the stock is worth more than its price or the stock is undervalued and that

it makes sense to buy the stock. On the other hand, if the intrinsic value is less

than the current share price, your analysis is showing that the stock is worth less

than its price or the stock is overvalued and that it makes sense to sell the stock.

There are various different methods available for finding the intrinsic value; the

premise behind all the strategies is the same i.e. a company is worth the sum of

its future cash flows discounted at an appropriate discount rate. If fair value

is not equal to the current stock price, fundamental analysts believe that the stock

is either over or under valued and the market price will ultimately gravitate towards

fair value. Fundamentalists do not need the advice of the random walkers and believe

that markets are weak form efficient. By believing that prices do not accurately

reflect all available information, fundamental analysts look to capitalize on perceived

price discrepancies. Fundamental analysis is the process of looking at a business

at the fundamental financial level. This type of analysis examines key ratios of

a business to determine its financial health and gives you an idea of the value

its stock. Investors use fundamental analysis alone or in combination with other

tools to evaluate stocks for investment purposes. The goal is to determine the current

worth and, more importantly, how the market values the stock.

[ + ] Q. Now I can understand how valuable fundamental analysis is? Can you tell

me how can one pick scrip for doing fundamental analysis?

Ans.

A There are various strategies for picking stock; the following are the generally

accepted among the investors. Value investing is supposed to be the one of the best-known

method available for picking stocks. The method is based upon the simple concept

that invest in those companies that are trading below their inherent worth. The

value investing involves the picking those stocks having strong fundamentals like

earnings, dividends, book value, and cash flow ,etc., and is selling at a low price.

Value investing involves the selection of those companies that seem to be incorrectly

valued by the market and therefore carries the potential of price appreciation when

the market corrects its error in valuation. As the method is revolved around the

determination of the true value of the underlying asset, value investors does not

pay any attention to the external factors affecting a company. Value investing assumes

that external factors are not inherent to the company, and therefore are not seen

to have any effect on the value of the business in the long run. This is in contradiction

with the Efficient Market Hypothesis (EMH), which claims that stock prices are always

reflecting all relevant information, and therefore are already showing the intrinsic

worth of companies.

Growth investing is yet another important strategy. It focuses on the future potential

of a company and gives much less emphasis on its present price. In contrast to value

investing, growth investing suggests the picking of those companies that are trading

higher than their current intrinsic worth based on the assumption that the company’s

intrinsic worth will grow and therefore share price will increase. Growth investing

involves the picking of those stocks that are likely to grow substantially faster

than others. It is mainly concerned with young companies. A growth investor looks

for investments in rapidly expanding industries. Objective of such investing is

to earn profits by way of capital gains but not dividends as almost all growth companies

reinvest their earnings and do not pay a dividend.

The GARP (Growth at a Reasonable Price) investing is a combination of both value

and growth investing. The strategy involves the picking of those stocks that look

somewhat undervalued and have solid sustainable growth potential stored in. The

strategy lies right in between the value and growth investing strategies. GARP investing,

like value investing, is concerned with the growth prospects of a company and are

like to see positive earnings numbers for the past few years, coupled with positive

earnings projections for forthcoming years.

GARP investing looks like the perfect strategy but it is not so easy as it sounds

because combining growth and value investing is very tough when it comes to practice.

CANSLIM acronym actually stands for a very successful investment strategy which

are elaborated hereunder:

C = Current Earnings

The strategy emphasises on the importance of choosing stocks whose earnings per

share in the most recent quarter have grown. The model maintains that investors

must study the company’s financials deeply and should recognize the window dressing,

if any, done in the balance sheet.

A = Annual Earnings

The strategy also acknowledges the importance of annual earnings growth as the current

earnings. The system maintains that a company should have shown respectable annual

growth in past few years.

N = New

The next acronym stands for anything new happening to or in the company. Any change

for the betterment of the company is necessary for the company to become successful.

The new may be anything like a new management team, a new product, a new market,

or even a new high/low in its stock price.

S = Supply and Demand

The method takes into account the analysis of supply and demand. The method assumes

that keeping all other things unchanged, it is easier for a smaller firm, with a

smaller number of shares outstanding or equity, to show outstanding gains. The reason

oblivious that a large-cap company requires much more demand than a smaller cap

company to show the same percent of gains.

L = Leader or Laggard

The method covers the important part of making distinction between the market leaders

and market laggards. In every sector or industry there are always certain stocks

that lead, providing high returns to investors, and those that lag behind, providing

relatively low returns.

I= Institutional Sponsorship

The strategy recognised the importance of companies having some institutional ownership.

The idea behind such a criteria is that if a company has no institutional sponsorship,

all of the thousands of institutional money managers have passed over the company.

Other side of the interpretation is that if a very large portion of the company’s

stock is owned by institutions then the company can be recognized as institutionally

over-owned and it is too late to buy into the company.

M = Market Fancy

This criterion is based upon the overall market direction or conditions. It is important

to consider the fact that the human psychologies do play its role in stock market,

so therefore it is necessary to recognize the overall mood of the market and move

consistent with the trend. This may be judged by the analysis of the price-volume

chart of the stock.

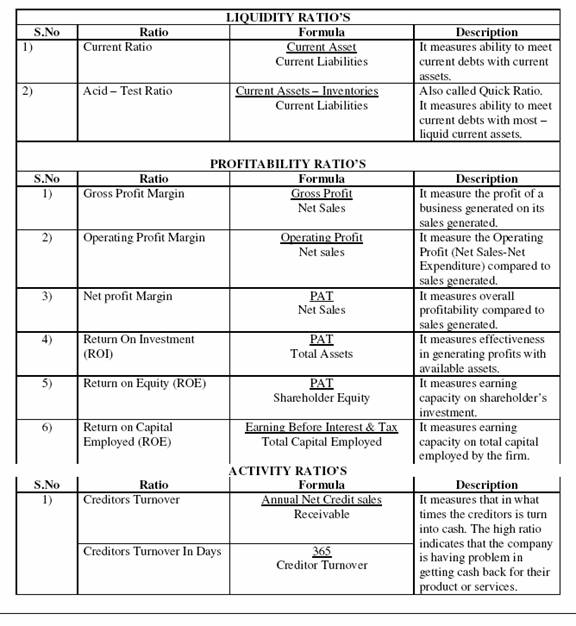

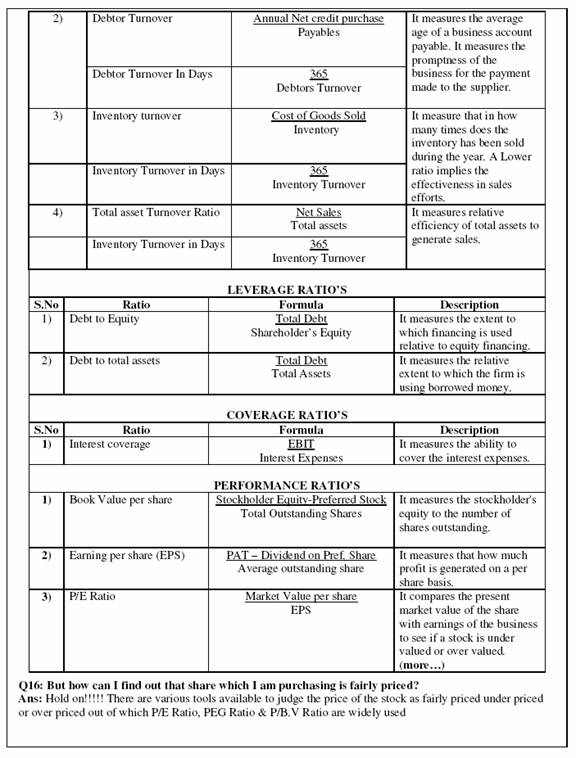

[ + ] Q Is it enough for doing fundamental analysis?

Ans.

A Fundamental analysis could be as deep as possible depending upon how much you

can extract from the financial number reported by the company & it also includes

doing Ratio analysis. Ratio analysis is a tool used to evaluate a firm’s financial

condition & performance.

[ + ] Q. Why bother with a ratio? Why not simply look at

raw data?

Ans.

A. Ratio is calculated because we get a comparison that may prove more useful than

the raw data. For different types of analysis, various kinds of Ratios are used.

[ + ] Q. Explain me in brief about P/E Ratio.?

Ans.

A. P/E is simply the ratio of a company’s share price

to its earnings per-share. Mathematically it can be calculated as:

P/E Ratio = Market Value per share / Earnings

per share

Theoretically, a stock’s P/E depicts how much investors are willing to pay per Re.

of earnings. Due to this very reason, the ratio is also termed as the “multiple”

of a stock. For example, a P/E ratio of 20 suggests that investors in the stock

are willing to pay Rs.20 for every Re.1 of earnings that the company generates.

The method is simple to analyse but it fails to take into account the company’s

growth prospects and other fundamentals. Generally P/E is calculated using EPS from

the last four quarters. This is also known as the trailing P/E. Sometime EPS is

calculated from estimated earnings expected over the next four quarters. This calculation

is known as the projected P/E. In third variation the PE is estimates of the next

two quarters based on the EPS of the past two quarters. There isn’t any significant

difference between these variations. However, it is important to know that, the

first calculation is based on the actual historical data. The other two calculations

are based on analyst estimates that may or may not be perfect or precise.

Although the EPS figure in the P/E is usually based on earnings from the last four

quarters, the P/E is somewhat more than a measure of a company’s past performance.

The ratio also takes into account market expectations for the future growth of a

company. The ratio helps us determine whether a company is over-valued or under-valued.

A stock is supposed to be undervalued if its PE ratio is lower than the PE ratio

of other stocks belonging to the same industry. In the similar way, a stock is supposed

to be overvalued if its PE ratio is higher than the PE ratio of other stocks belonging

to the same industry. But P/E analysis is only valid in certain circumstances and

it has some shortcomings attached with it. Some of the shortcomings are as hereunder:

Accounting policies

The EPS can be manipulated, twisted, poked and squeezed into various numbers depending

upon the accounting policies. As a result of which, we often don’t know whether

we are comparing the same figures.

Inflation

During the times of high inflation, inventory and depreciation costs tend to be

understated because the replacement costs of goods and equipment rises with the

general level of prices. Thereby, P/E ratios look like lower during times of high

inflation because the market believes earnings are artificially distorted upwards.

Analysis

A High P/E ratio does not necessarily imply that a company is overvalued. Rather,

it could mean that the market believes the company is headed for good time ahead.

Similarly, a low P/E ratio does not necessarily imply that a company is undervalued.

Rather, it could mean that the market believes the company is headed for trouble

in the near future. So, we can conclude that the P/E often doesn’t tell us much,

but when it comes to comparing one company to another in the same industry or to

the market in general or to the company’s own historical P/E ratios, the same is

quite useful. Stock analysis requires a great deal much more than understanding

a few ratios. It should be kept in mind that the P/E is one part of the game.

[ + ] Q. And what is this PEG Ratio?

Ans.

A : While the PE ratio is a commonly used ratio, some investors for more analysis

make use of the PEG ratio. The ratio helps in determining a stock’s value while

taking into account earnings growth. It can be mathematically calculated as:

PEG Ratio= PE ratio / Annual EPS Growth

The ratio is a widely used analytical tool for determining the true potential of

the stock. It is more acceptable as compared to the PE ratio because it also accounts

for growth. Similar to the P/E ratio, a lower PEG implies that the stock is undervalued

and otherwise overvalued. The PEG ratio compares a stock’s P/E ratio to its expected

EPS growth rate. PEG ratio is equal to one implies that the market price of the

stock fully reflects the stock’s EPS growth. PEG ratio greater than one indicates

that the stock is overvalued or that the market expects future EPS growth to be

greater than what is in current. PEG ratio less than one indicates that the stock

is undervalued or that the market expects future EPS growth to be less than what

is in current. As in PE ratio, here also we can use the ratio for comparison in

the peer group or industry. It is important to note that the PEG ratio should be

used as additional information to get a clear perspective of the investment potential

of a company. The ratio can give you a clear picture if you know how to handle it.

[ + ] Q. Then what is P/BV ratio?

Ans.

A: Likewise other ratios the P/BV ratio is also a useful tool in analyzing a stock.

The ratio can be calculated mathematically as follows:

P/BV ratio= Current Market price/ Book value

A P/BV ratio indicates how much investors pay for what would be left of the company

if it went out of business immediately. If a stock is trading for more than their

book value or in other words P/BV ratio is more than 1, it generally implies that

the stock is overvalued. However, it may also tell differently that investors expect

the company to have a very good return on its assets. Whereas, if a stock is trading

for less than their book value or in other words P/BV ratio is less than 1, it generally

implies that the stock is undervalued. It may also imply that investors expect the

company to have a very poor return on its assets. P/BV ratio may not be so meaningful

if a company has a large percentage of intangible assets, as they are very difficult

to quantify, thereby making the book value uncertain.

[ + ] Q. Now what’s technical analysis?

Ans.

A. Technical analysis is a process of identifying trend reversals to formulate the

buying & selling strategies. Technical analysis includes various tools through

which one can analyse the relationship between supply & demand for stocks &

can predict the future movement of the same. Technical analysis is based on the

charts of individual stocks. The market value of the stock is ascertained by the

supply & demand factors. The movement in security shows the sentiment of market

players in it. Basically we study trend of the stocks. Trends simply indicate the

change in investor expectation. It is a kind of direction of movement. The share

prices either decreases, increases or remains flat. Technical Analysis is based

on three assumptions.

1) The market value of the scrip is determined by Interaction of supply & Demand.

2) Market discounts everything.

3) Market always moves in a trend.

[ + ] Q.

Trend. is that something related to fashion? But what is the link between fashion

& Stock market?

Ans.

A. Oh yes. you can say that. Fashion also follows some trend. Same with the stock

market. It moves in a trend. Stock market trend is divided into three parts i.e

Primary waves, Secondary waves, Tertiary waves. The primary wave remains for a period

of at least One year. The Secondary wave remains for at least 6 months. Time frame

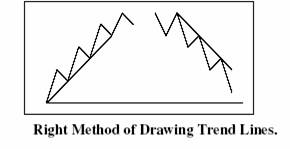

for the Tertiary waves is limited to one month. For making a perfect trend line,

one should consider whether while making a trend line if more points are met, the

more accurate would be the trend line. The bullish trend can be drawn by joining

lows of the waves whereas the bearish trend can be drawn by joining highs of the

waves as depicted in the following diagram. At least two points should be met while

making trend line. Remember, Trend line cannot be horizontal or vertical. Always

draw trend line from lowest or from highest points, never from in between as shown

in the graph.